What If Tax Estimation Was Not Done Properly?

What are the possible consequences if tax estimation is not done properly?

- A taxpayer who fails to submit Form CP204 will be liable to pay a fine of not less than RM200 and not more than RM2,000 or to imprisonment for a term no than 6 months, or to both.

- Taxpayers who are late in making the instalment payment according to CP205 will be penalised by having a 10% penalty imposed on their balance of unpaid tax.

- If the tax payable exceeds the original or revised estimate (whichever latest) by 30%, the difference in the estimation will be charged with a 10% penalty.

Pursuant to subsection 107C (2) of the Income Tax Act (“ITA”) 1967, companies, cooperatives, trust bodies, and limited liability partnerships (“LLPs”) in operation must submit the CP204 form via e-filing not later than 30 days before the beginning of the basis period for a year of assessment (“YA”). As an example, if the YA of a company starts on 1 January 2023, the due date to submit the Form CP204 for that basis period of YA is 1 December 2022.

Next, let’s have a look at how to do the tax estimation. The estimate of tax payable for a year shall not be less than 85% of the revised estimate of tax payable for the immediately preceding YA. If no revised estimation is furnished, the tax estimation shall not be less than 85% of the estimate of tax payable for the immediately preceding YA.

What if changes occur after a company has submitted the initial tax estimation? Not to worry, a company can revise the tax estimation in the 6th and 9th month of the basis period for a YA by using the Revised Estimate of Tax Payable Form (CP204A) via the electronic medium.

Did you know that careful planning and estimation of tax payable can help you improve your company’s cash flow?

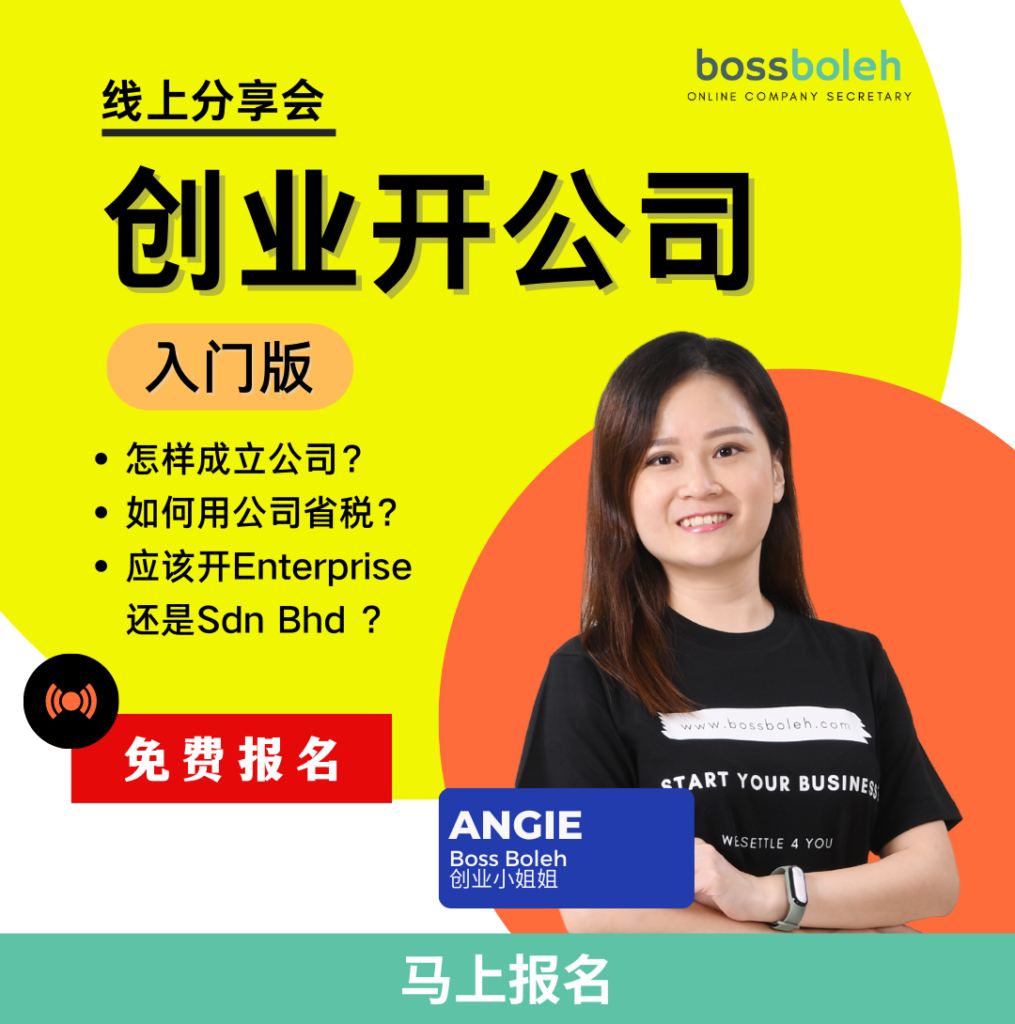

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

For more information, get in touch with us on WhatsApp at 018-7678055!