If you earn income from renting out property, the income is taxable under Malaysian law. However, you can reduce your tax by claiming legitimate expenses. Learn which costs are deductible, which are not, and how to keep proper records to ensure your rental income is reported accurately and fairly.

Tag: Tax

What Is Withholding Tax in Malaysia?

Withholding Tax (WHT) is a key part of Malaysia’s tax system, requiring businesses to deduct tax at the source when making certain payments. Understanding your WHT obligations is essential to avoid penalties, protect cash flow, and stay compliant with the Inland Revenue Board of Malaysia (IRBM). This article breaks down why WHT matters and the risks of non-compliance.

When to Claim Tax Agent & Statutory Filing Fees: Avoid Common Mistakes in YA 2024

As we approach tax season, many business owners and finance teams ask: “Can we deduct tax agent and statutory filing fees in the current year of assessment?” Let’s clear up the confusion. Tax Deduction Rule: “Incurred Basis” Applies Under Malaysian tax law, expenses are only deductible when they are incurred — not when they relate… Continue reading When to Claim Tax Agent & Statutory Filing Fees: Avoid Common Mistakes in YA 2024

Understanding Tax Penalties in Malaysia: A Comprehensive Guide

In Malaysia, the Inland Revenue Board (LHDN) enforces strict tax compliance to ensure the integrity of the national tax system. Non-compliance with tax obligations can lead to significant penalties, including fines, imprisonment, or both. This guide outlines the various tax offences and corresponding penalties to help taxpayers stay informed and compliant. 1. Failure to Furnish… Continue reading Understanding Tax Penalties in Malaysia: A Comprehensive Guide

Tax Quick Guide: Forest City Special Financial Zone Tax Incentive

Introduction of Forest City Forest City is an integrated residential development and private town located in Iskandar Puteri, Johor, Malaysia. It is situated in the southwestern part of Johor Bahru District, the second largest district in Malaysia by population. Forest City, with its combination of a duty-free island within a special financial zone, presents a… Continue reading Tax Quick Guide: Forest City Special Financial Zone Tax Incentive

Budget 2025: Introduction of 2% Dividend Tax

The introduction of a 2% dividend tax, as announced in the 2025 Budget proposal, breaks the long-standing tradition of dividends being tax-exempt for individual shareholders. Starting from 1 January 2025, individual shareholders with annual dividend income exceeding RM100,000 will be subject to this new tax, catching many off guard. For high-income earners, this not only… Continue reading Budget 2025: Introduction of 2% Dividend Tax

What if I made a mistake on income tax return form?

Amending the Individual Income Tax Return Form Imagine this: you’re filing your taxes, and right after you click that submit button—oh no—you see an extra zero keyed in, or you could have missed out on some tax reliefs you were actually entitled to. You click away on the LHDN website in a frenzy, only to… Continue reading What if I made a mistake on income tax return form?

Tax Payment of Companies

Registered Companies, Limited Liability Partnerships, Trust Bodies and Cooperative Societies which are dormant and/or have not commenced business operation are not required to furnish tax estimate. But it is required for existing companies to do so.

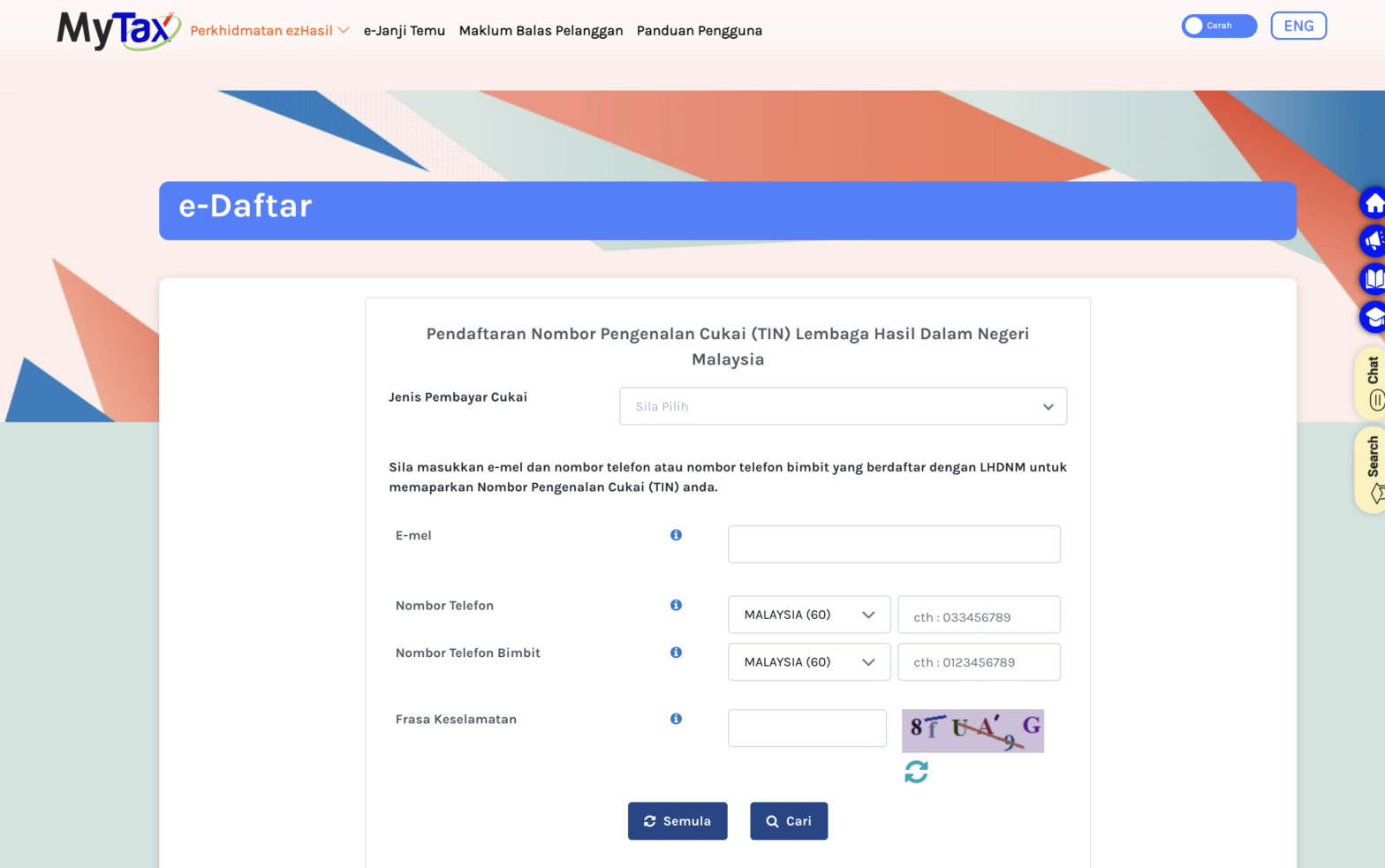

How To Register LHDN Employer Tax File Number (No. Majikan)

This guide will show you how to register for an income tax reference number (E- number).