Malaysia is a prime logistics hub in Southeast Asia, offering excellent infrastructure and strategic advantages for entrepreneurs. If you’re looking to start a logistics company in Malaysia, this guide covers the essential steps and key industry insights to help you get started

Tag: industry

Budget 2025: Introduction of 2% Dividend Tax

The introduction of a 2% dividend tax, as announced in the 2025 Budget proposal, breaks the long-standing tradition of dividends being tax-exempt for individual shareholders. Starting from 1 January 2025, individual shareholders with annual dividend income exceeding RM100,000 will be subject to this new tax, catching many off guard. For high-income earners, this not only… Continue reading Budget 2025: Introduction of 2% Dividend Tax

🧳Running a Travel Business? Here’s How to Get Licensed with MOTAC! ✈️

If you’re planning to operate a tour or travel agency in Malaysia, getting licensed by the Ministry of Tourism, Arts and Culture (MOTAC) is essential. Here’s a simplified, step-by-step guide to help you navigate the licensing process—— especially for foreign entrepreneurs or businesses. 📝Step 1: Register Your Company Start by incorporating a Sdn. Bhd. (private… Continue reading 🧳Running a Travel Business? Here’s How to Get Licensed with MOTAC! ✈️

Industry Guide on How To Start a Non-Profit Organisation in Malaysia

Here’s the article that is going to show you the ropes to start your desired NPO. Every article has a beginning, start now with Bossboleh.

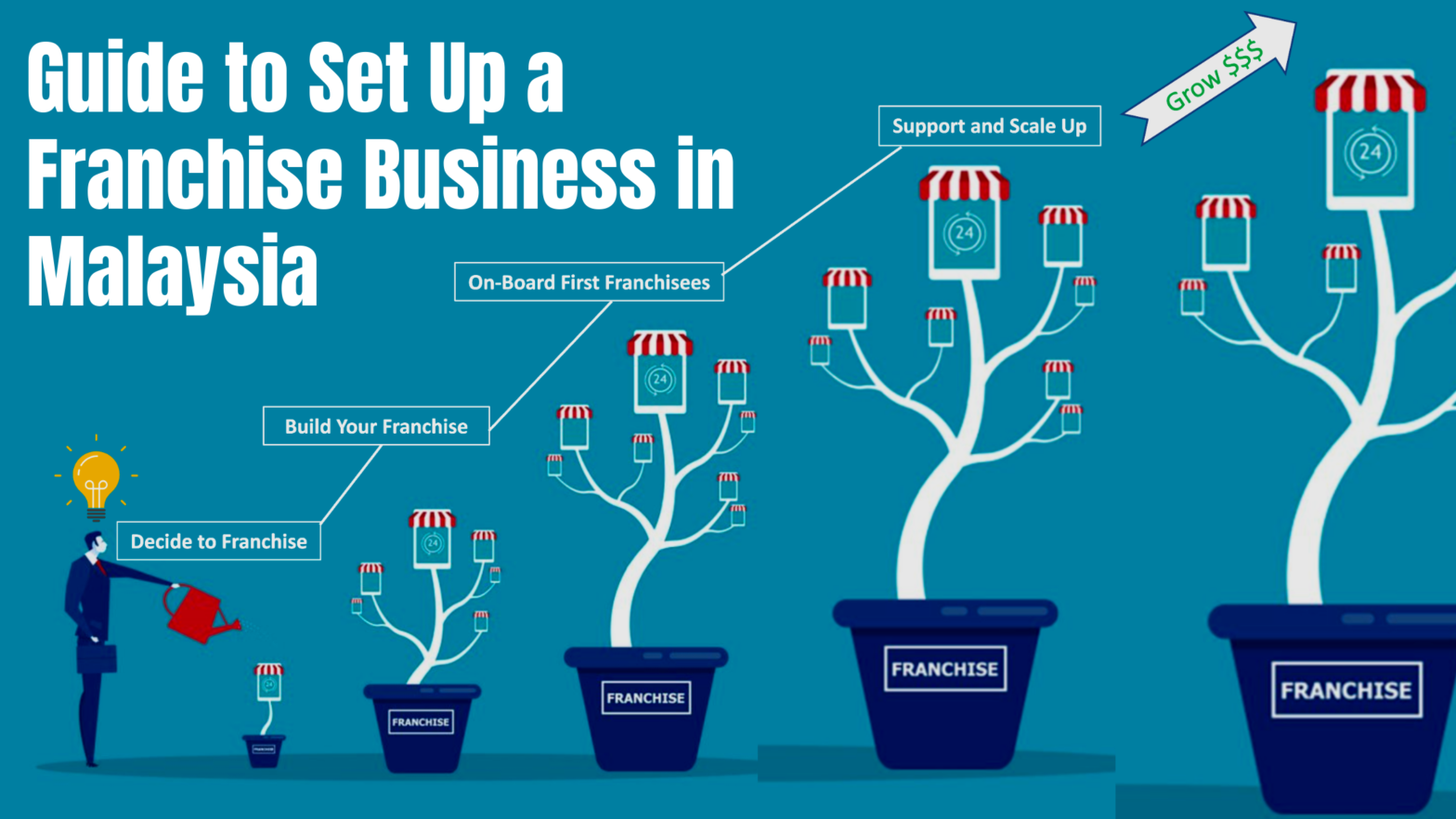

Industry Guide to Franchise Business in Malaysia

This article will show you the steps to kickstart your franchise business in Malaysia. Let’s start your business today with Bossboleh!

Industry Guide on How To Set Up a Hotel Business in Malaysia

In this article, we look at several things when opening up your own hotel business.

Industry Guide to Set Up a Construction Business in Malaysia

In this article, we will show you some guidelines to start a construction company in Malaysia.

Industry Guide to Set Up an IT-Solutions in Malaysia

This article will show you the steps to kickstart your IT solutions business in Malaysia.

Industry Guide to Set Up a Pharmaceutical Business in Malaysia

In this article we look at the information on the pharmaceutical business and what you need to get started.

Industry Guide on How To Set Up a Childcare Centre in Malaysia

In this article, you’ll find the tips on opening your childcare centre in Malaysia.