Yes, that’s correct—but only if your company meets the new audit exemption thresholds introduced by SSM! Download the SSM guide HERE This game-changing policy could save thousands on audit fees for eligible SMEs. However, companies still need to: 1️⃣ Submit Unaudited Financial Statements (UAFS) to SSM annually (MBRS submission fee, estimated cost: RM 1,000) 2️⃣ Tax filing : submit Form C to LHDN using… Continue reading 🚨 Sdn Bhd Companies No Longer Need Auditors? 🚨

Tag: guide

Budget 2025: Introduction of 2% Dividend Tax

The introduction of a 2% dividend tax, as announced in the 2025 Budget proposal, breaks the long-standing tradition of dividends being tax-exempt for individual shareholders. Starting from 1 January 2025, individual shareholders with annual dividend income exceeding RM100,000 will be subject to this new tax, catching many off guard. For high-income earners, this not only… Continue reading Budget 2025: Introduction of 2% Dividend Tax

🧳Running a Travel Business? Here’s How to Get Licensed with MOTAC! ✈️

If you’re planning to operate a tour or travel agency in Malaysia, getting licensed by the Ministry of Tourism, Arts and Culture (MOTAC) is essential. Here’s a simplified, step-by-step guide to help you navigate the licensing process—— especially for foreign entrepreneurs or businesses. 📝Step 1: Register Your Company Start by incorporating a Sdn. Bhd. (private… Continue reading 🧳Running a Travel Business? Here’s How to Get Licensed with MOTAC! ✈️

Responsibilities of an Employer

What are the responsibilities of an employer? In this article, you will be guided to understand the virtues an employee must uphold.

Guide to Halal Certificate Application for Chain Restaurant

Application for a Halal Cert. may not be easy. Owning multiple chain restaurants is already a feat. but obtaining a certificate for being Halal can be done, if you follow the steps below.

Industry Guide on How To Start a Non-Profit Organisation in Malaysia

Here’s the article that is going to show you the ropes to start your desired NPO. Every article has a beginning, start now with Bossboleh.

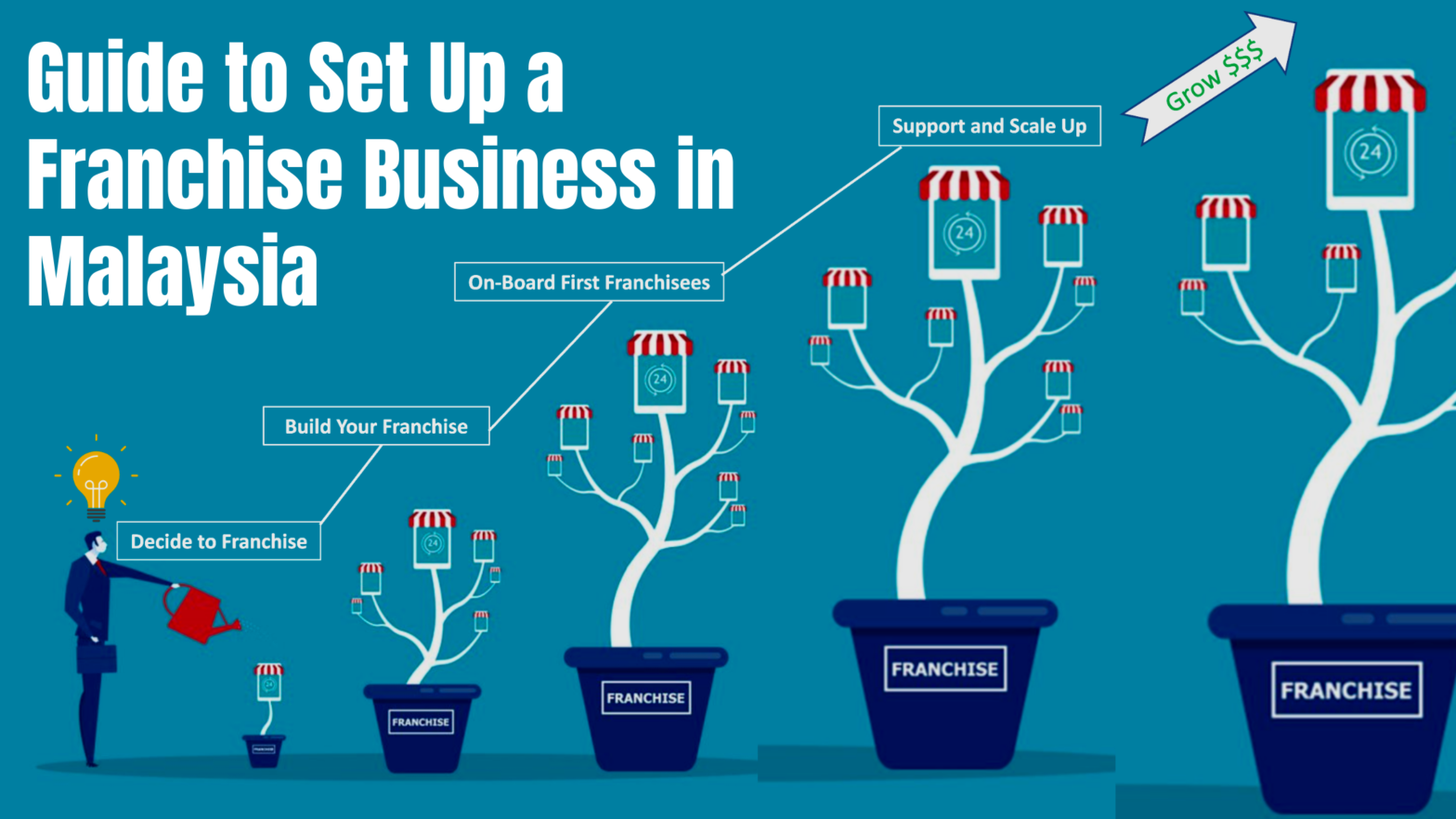

Industry Guide to Franchise Business in Malaysia

This article will show you the steps to kickstart your franchise business in Malaysia. Let’s start your business today with Bossboleh!

Industry Guide on How To Set Up a Hotel Business in Malaysia

In this article, we look at several things when opening up your own hotel business.

Industry Guide to Set Up a Construction Business in Malaysia

In this article, we will show you some guidelines to start a construction company in Malaysia.

Industry Guide to Set Up an IT-Solutions in Malaysia

This article will show you the steps to kickstart your IT solutions business in Malaysia.