Yes, that’s correct—but only if your company meets the new audit exemption thresholds introduced by SSM!

Download the SSM guide HERE

This game-changing policy could save thousands on audit fees for eligible SMEs. However, companies still need to:

1️⃣ Submit Unaudited Financial Statements (UAFS) to SSM annually (MBRS submission fee, estimated cost: RM 1,000)

2️⃣ Tax filing : submit Form C to LHDN using final management accounts.

Key Highlights:

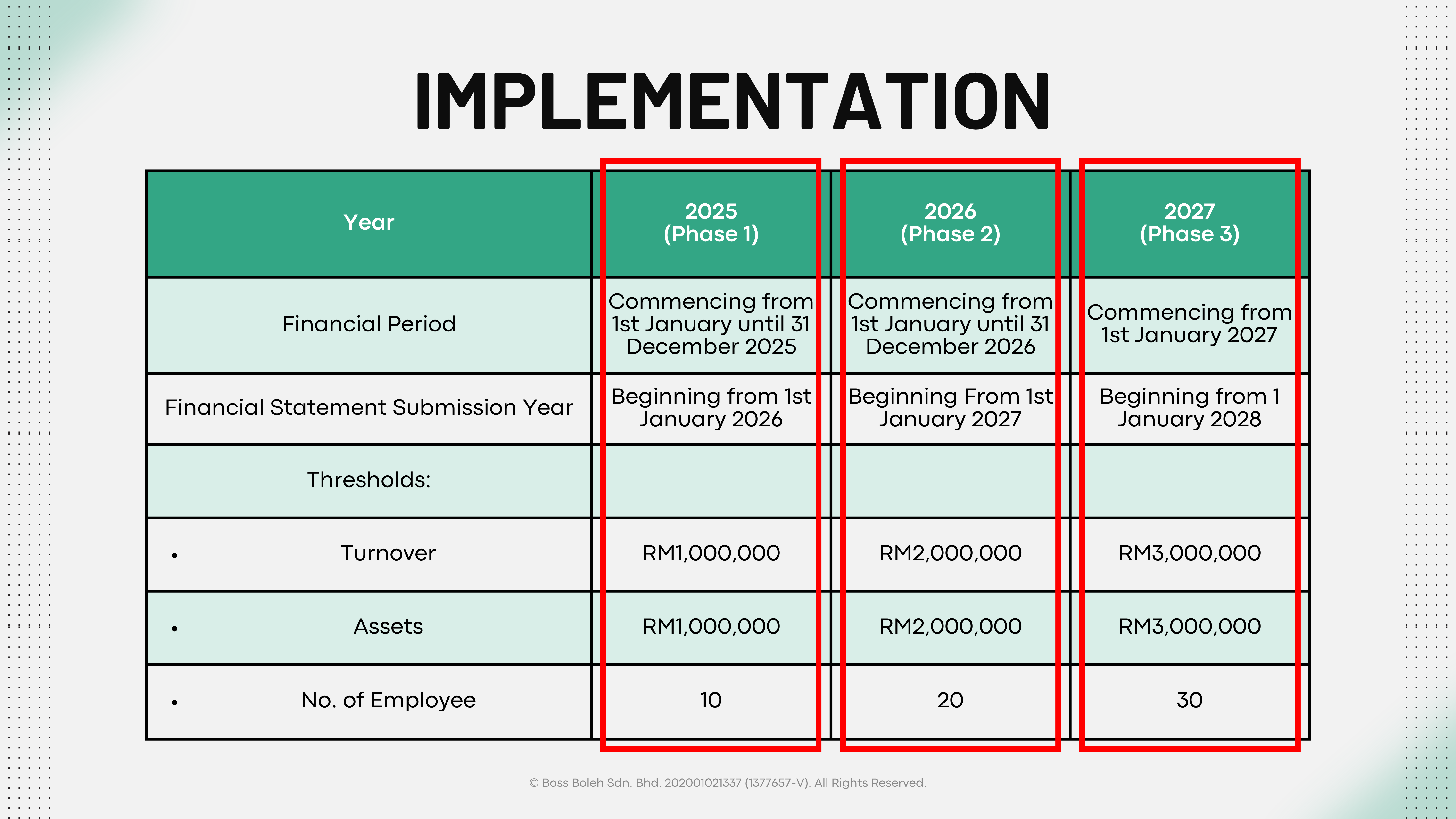

Phased Thresholds:

• FYE 2025: Revenue not exceeding RM1 million.

• FYE 2026: Revenue not exceeding RM2 million.

• FYE 2027: Revenue not exceeding RM3 million.

Minimum Requirement:

Current financial year and in the immediate past two (2) financial years does not exceed the threshold.

How Does Malaysia Compare Globally?

• 🇸🇬 Singapore: Audit only if revenue > SGD10M.

• 🇭🇰 Hong Kong: Audit is compulsory (except dormant companies).

• 🇦🇺 Australia: Audit only if revenue > AUD50M.

What Does This Mean for SMEs?

Lower compliance costs = More resources to reinvest in growth! This reflects SSM’s commitment to building a business-friendly environment while maintaining financial transparency.

Reminder: Stay on top of your accounts and plan your taxes wisely! A messy financial record could cost you more in the long run!

You can subscribe to “taxPOD”, a tax e-learning platform to learn how to save more tax. Only pay what we owe, not to pay a single cent of unnecessary tax.

💬 What do you think about this phased approach? Will this be a win-win for businesses and auditors?

Want to learn more about starting a business? How to set up a company? What to look out for when starting a business? Join our online sharing session!

For more details, feel free to WhatsApp us!

WhatsApp: 018-7678055