Recently, I attended a court session where a company director was charged under Section 409 of the Malaysian Penal Code. He faces a minimum of 2 years in jail, mandatory caning, and fines. This is the harsh reality directors face when breaching the immense trust placed in them.

So, What Is Section 409?

As a company director, do you truly understand the severe consequences of Criminal Breach of Trust (CBT)?

Your role comes with significant responsibility, and a breach of that trust under Section 409 could lead to devastating penalties. The law holds directors to a higher standard because their actions directly impact their company, shareholders, and sometimes the public.

Key Legal Provisions

- Section 408: Applies to clerks, finance staff, or anyone in a subordinate role who commits CBT. Penalties: Imprisonment (1–14 years), mandatory caning, and fines.

- Section 409: Specifically targets public servants or agents, including company directors.

Penalties: Imprisonment (2–20 years), mandatory caning, and fines.

Why Are Directors Held to a Higher Standard?

As agents of the company, directors manage assets and act on behalf of shareholders, requiring a high level of trust and accountability. Misappropriation by a director can have far-reaching consequences, including financial ruin and loss of public confidence. For this reason, Section 409 carries stricter penalties compared to Section 408.

Section 409

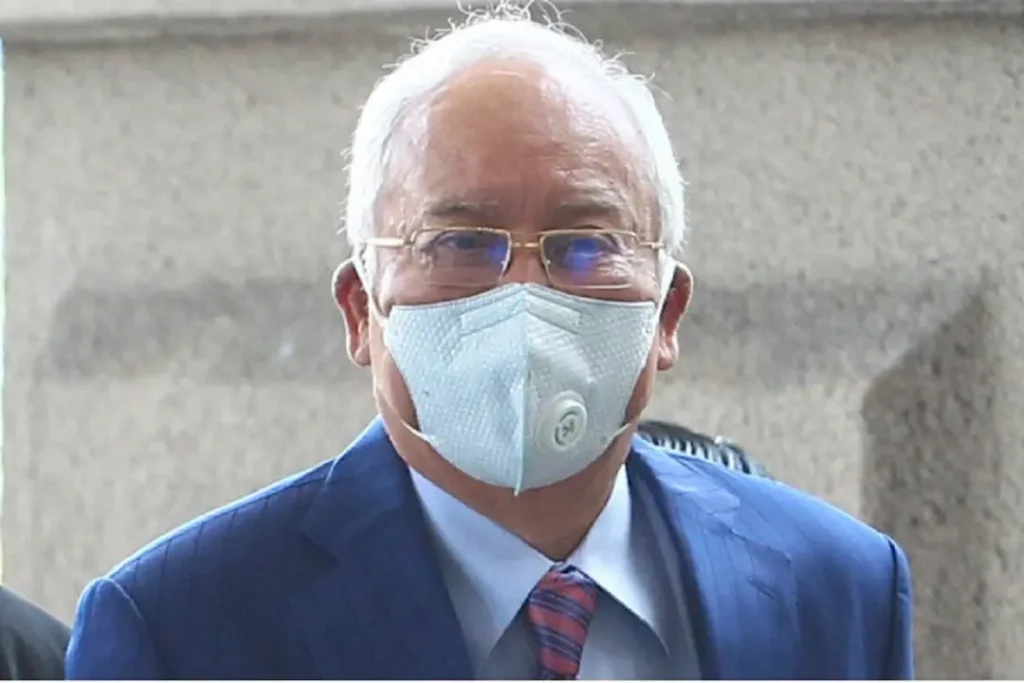

Case Study: Najib Razak and SRC International (2020)

A high-profile reminder of the gravity of Section 409 is the SRC International case. Former Prime Minister Najib Razak was charged with misappropriating public funds, underscoring the severe repercussions for breaching fiduciary duties.

Source: The Edge Malaysia

Case Study 2: Fashion Valet (2024)

Vivy and Fadza, co-founders of FashionValet, (funded by Khazanah and PNB), were charged under Section 409 of the Malaysian Penal Code for misusing RM8 million by transferring it to their private company, 30 Maple Sdn Bhd, without board approval.

Sources: Malay Mail

Case Study 3 : Audit Firm Gxx Malaysia (2022)

The managing partner of Gxx Malaysia was charged under Section 409 of the Malaysian Penal Code for criminal breach of trust involving RM2.38 million.

He pleaded not guilty to all charges and was released on bail. Subsequently, in November 2022, he faced additional charges related to money laundering involving RM115 million.

In March 2023, he was acquitted of all charges.

Sources: The Edge Malaysia

Section 408

Case Study: Assistant Manager in Sabah (2022)

In September 2022, a 30-year-old assistant manager at a supermarket in Sabah was charged under Section 408 for misappropriating daily sales totaling over RM25,000. He pleaded guilty and was sentenced to two years in prison and two strokes of the cane.

Sources: Daily Express

Case Study 2: Accounts Executive in Bangsar (2020)

In 2019 and 2020, an account executive at Bangsar misappropriated RM84,000 of company funds for personal gain. Falsified payment authorization letters to redirect funds intended for a supplier to another company. She was sentenced to 2 years imprisonment and fined RM170,000.

Sources: EFS Kehakiman

Takeaway for Directors

The consequences of breaching trust are real and harsh: a minimum of 2 years in jail, mandatory caning, and fines. Directors must safeguard their legal standing by upholding integrity and diligently fulfilling their fiduciary responsibilities. Don’t let ignorance or negligence jeopardize your career or freedom.

Takeaway for Accounts, Finance, and Those Managing Company Assets

This isn’t just a warning for directors. Accounts clerks, finance staff, or anyone handling company funds or assets could be charged under Section 408 for CBT. The penalties include at least 1 year in jail, mandatory caning, and fines. While slightly lighter than Section 409, its impact on your career and reputation is equally devastating.

A Wake-Up Call for All

This is a wake-up call and a reminder to act responsibly, emphasizing the importance of understanding and complying with fiduciary and ethical obligations. Whether you’re a director, finance professional, or employee managing company assets, adhering to ethical practices is crucial to protect your reputation, career, and freedom.

#BossBoleh #SdnBhd #DirectorsResponsibilities #Compliance #FiduciaryDuties #PenalCode

Want to know more in detail? Find out in our upcoming webinar!

Contact us on WhatsApp for further details!