Have you ever calculated stamp duty of shares? Come test out our own calculator inside this article!

Author: Boss Boleh

Inspire Me Sdn Bhd

Hear the inspirational movement rooted by Joshua of InspireSMe as he embarks on sparking e-learning content for trainers, as well as sharing business knowledge on the ssm platform.

Kameko Food Sdn Bhd

Hear how “sauce” can be a driving factor for Janet’s Kameko Food, as they venture into the e-commerce platform headstrong, knowing there will be competition along the way.

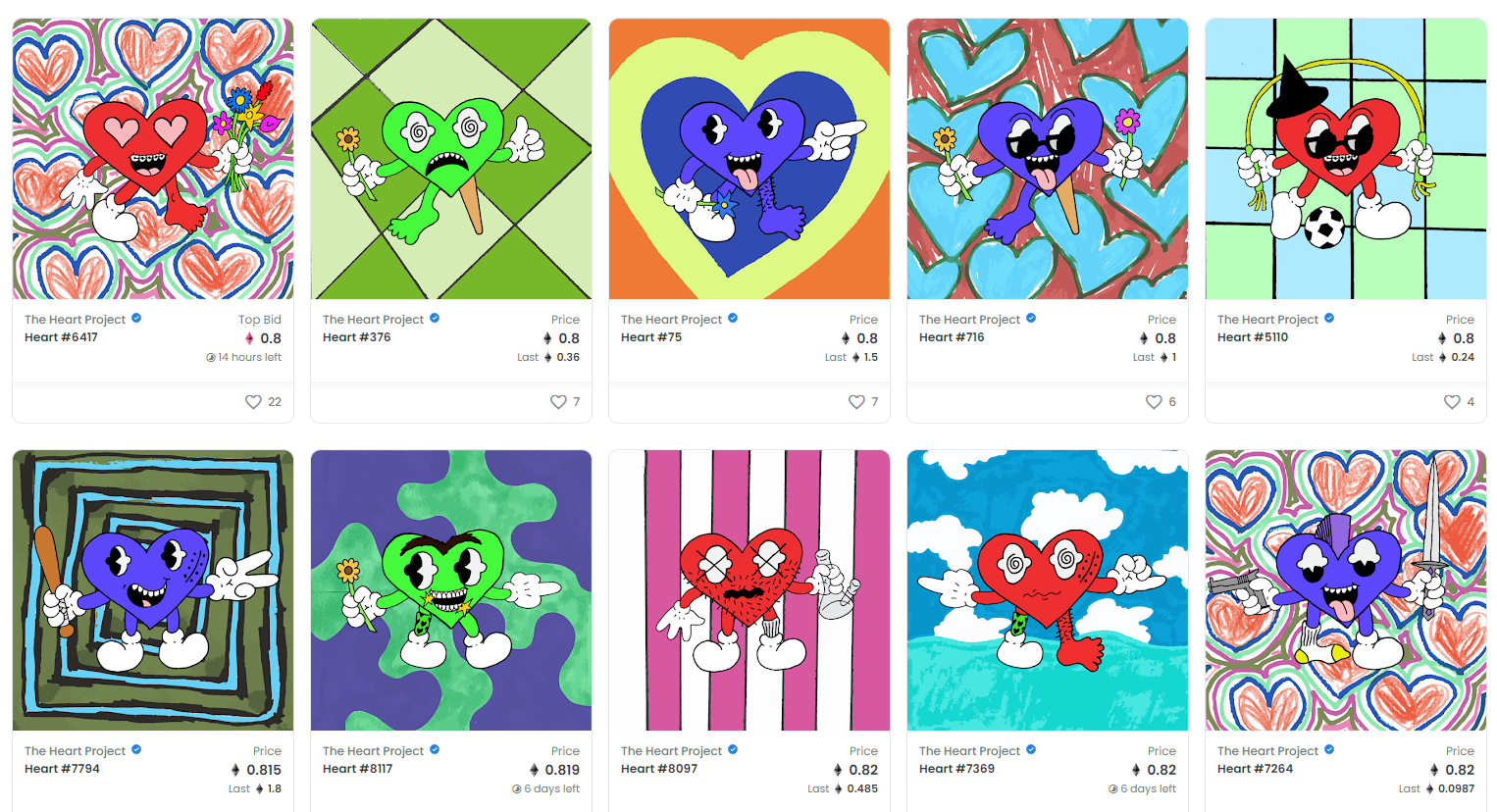

NFT: The New Investment Trend?

NFT(s) are usually used to represent the ownership of different unique items like art, collectibles, even real estate. NFTs are not like cryptocurrencies that can be exchanged or traded at equivalency

Matslo Group Sdn Bhd

Hear what Hafizi of Matslo Group has to say about his transformation from an enterprise to sdn bhd through F/B business.

AFB Commerce Sdn Bhd

Hear how AFB Commerce’s transformation to a sdn bhd benefited them to grants that were given by the government resulting in their startup

Aquajunkies Sdn Bhd

Hear how Sean made his passion in aquascaping become a reality, as he launches his own sdn bhd, Aquajunkies. Talk about driven passion!

Urbani Kitchen Sdn Bhd

Hear from Rebecca of Urbani Kitchen how an F/B business in frozen food can be a thing in Malaysia nowadays, together with her experience in opening a sdn bhd.

Industry Guide on How to Set Up a Recruitment Agency

The reason to set up a recruitment agency is to help bridge both employers to their suitable employees and to get the job seekers to find jobs within their expertise.

Industry Guide to Clinic Business in Malaysia

Ever since the pandemic, there has been a rapid growth in demand for clinics in Malaysia. Having to own a clinic of your own gives you the empowerment that you are in total control.