Application for a Halal Cert. may not be easy. Owning multiple chain restaurants is already a feat. but obtaining a certificate for being Halal can be done, if you follow the steps below.

Author: Boss Boleh

Memorandum and Articles of Association (M&A) & Constitution in Malaysia

It is not necessary to have a company constitution in Malaysia, however, it is essential for a contract to specify the business’s interaction with its audience. This article provides an understanding of what M&A, and Malaysian Constitution is.

Certificate of Resident

To be a residence of Malaysia, one must first understand the format of how can one be entitled so, together with pending documents needed to be issued. This article will lead you the way.

Industry Guide on How To Start a Non-Profit Organisation in Malaysia

Here’s the article that is going to show you the ropes to start your desired NPO. Every article has a beginning, start now with Bossboleh.

SME Soft Loan Scheme: All-Economic Sector Facility (AES)

In budget 2022, the government allocated total of RM6.5 billion to the All-Economic Sector Facility (AES). This brings some of us to the following questions, what is AES and how does it work?

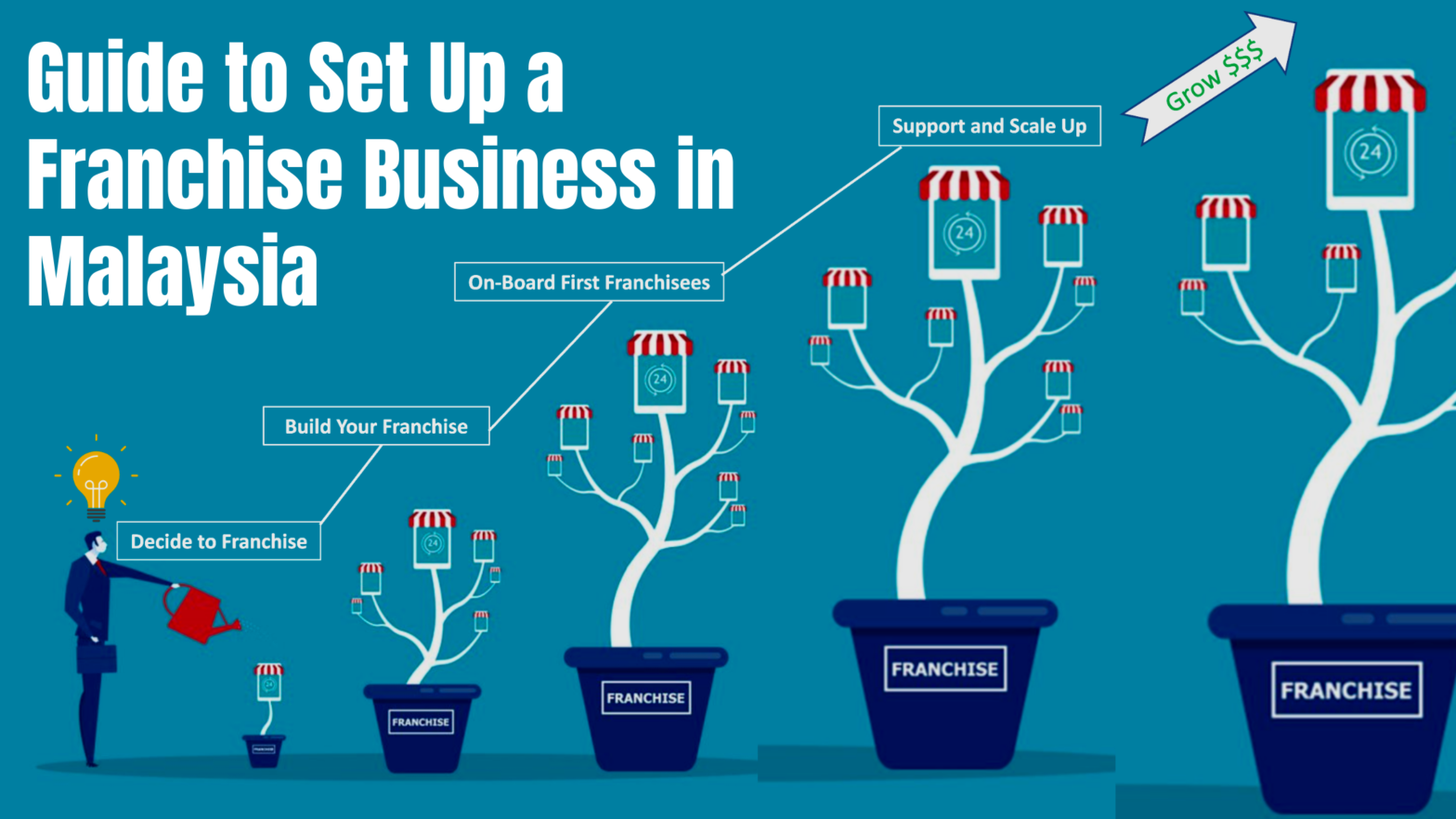

Industry Guide to Franchise Business in Malaysia

This article will show you the steps to kickstart your franchise business in Malaysia. Let’s start your business today with Bossboleh!

Industry Guide on How To Set Up a Hotel Business in Malaysia

In this article, we look at several things when opening up your own hotel business.

Industry Guide to Set Up a Construction Business in Malaysia

In this article, we will show you some guidelines to start a construction company in Malaysia.

Industry Guide to Set Up an IT-Solutions in Malaysia

This article will show you the steps to kickstart your IT solutions business in Malaysia.

Industry Guide to Set Up a Pharmaceutical Business in Malaysia

In this article we look at the information on the pharmaceutical business and what you need to get started.