1st September 2022, all employees will be protected by the Employment Act 1955. In view of the above update, we have gathered some FAQs about the topic and listed them down as follows: All employees covered by the EA Question: What is the impact of the EA being applicable to all employees? Answer: It means that ALL… Continue reading FAQ for Employment (Amendment of First Schedule) Order 2022

Author: Boss Boleh

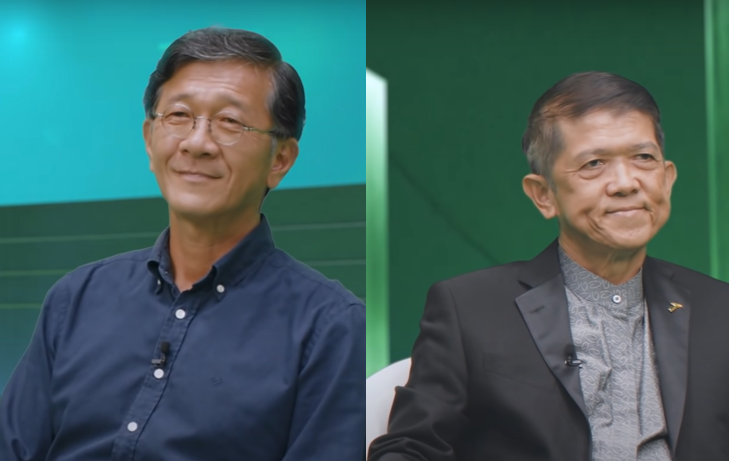

The Pros and Cons of Running a Family Owned-Business

Spark Let’s Talk by Maxis Business is a talk show that welcomes prominent Malaysian entrepreneurs to discuss opportunities and problems faced by SMEs in Malaysia, particularly as they adjust to the new normal. For startup entrepreneurs or those looking forward to learn something, this is a show for you. Today we will be looking at… Continue reading The Pros and Cons of Running a Family Owned-Business

Who is Not Eligible to Become a Director of Sdn. Bhd.

Click here to read the Chinese version 点击此处阅读华语版本 Before opening a company, it is necessary to know and understand the qualifications and disqualifications of company directors. Other than that, it is important that directors of Malaysian companies act according to the responsibilities of their duties in order to avoid breaching the company law and committing… Continue reading Who is Not Eligible to Become a Director of Sdn. Bhd.

Taxpayer Responsibilities (for Companies in Malaysia)

Are you aware of the taxpayer responsibilities by a company in Malaysia? Below here we have compiled all the information about taxpayer responsibilities according to LHDN. Read further to find out more: Categories Description Leave Passage Leave passage within Malaysia not exceeding three times in a year and one leave passage outside Malaysia not exceeding… Continue reading Taxpayer Responsibilities (for Companies in Malaysia)

Secretary Fee & Tax Agent Fee

Tax Deduction for Secretarial and Tax Filing Fee Pursuant to the Income Tax (Deduction For Expenses in Relation to Secretarial Fee and Tax Filing Fee) Rules 2020 [P.U.(A) 162/2020] published by the Federal Government on 19 May 2020, the following expenses incurred shall be allowed for tax deduction with effect from year of assessment 2020: Before YA… Continue reading Secretary Fee & Tax Agent Fee

Distribution Strategies for the Food Manufacturing Industry

Maxis Business Spark series, Let’s Talk invites business owners from various industries to share, discuss and debate business strategies. Episode 3 of this series is called “Spark Let’s Talk: From Production to Consumption”, it has focused on the food manufacturing industry and what strategies they took to sustain the business. Guests invited to this episode are… Continue reading Distribution Strategies for the Food Manufacturing Industry

Is There a One-Size Fits All Strategy For F&B?

Spark Let’s Talk by Maxis Business is a talk show that invites leading Malaysian entrepreneurs to share their perspectives about opportunities and issues encountered by SMEs in Malaysia, especially when businesses are adapting to the new normal. Episode 1 of this series has focused on the Food and Beverages (F&B) sector as it is one… Continue reading Is There a One-Size Fits All Strategy For F&B?

Introduction To Telecommunications Business in Malaysia

In the 1830s, the telegraph became the first mechanical communications technology, which was hailed as a huge triumph at the time. After a few hundred years, we now have cutting-edge technology that reduces the time it takes to transmit data from hours to mere seconds. Today, communication is inevitable in our daily lives and it… Continue reading Introduction To Telecommunications Business in Malaysia

Introduction to Publishing Business in Malaysia

Digital materials have been more popular in Malaysia during the past several years, and people’s need for educational resources is rising along with the literacy rate. Thus, it might be a good idea to venture into the publishing industry. Your clients will be reassured that your brand is independent, reputable, and trustworthy if you have… Continue reading Introduction to Publishing Business in Malaysia

Things to Know About Event Management Business in Malaysia

Numerous events go around in our lives that we might not even notice, such as workshops, weddings, conferences, award ceremonies and so forth. One successful event is determined by the outstanding efforts and ideas executed by a team of event management experts. Anyone can have the potential to become a key player among an event… Continue reading Things to Know About Event Management Business in Malaysia