Real Property Gains Tax Exemption

The disposal of real property in Malaysia is subject to real property gains tax (RPGT) based on a scale of rates ranging from 0% to 30% depending on the length of time the real property is held. However, there are certain situation where gains from disposal of real property are given tax exemption.

For more effective planning, it is essential to understand the real property transactions that are exempted from RPGT. Here, let’s look at some of the transactions that are exempted from RPGT, as well as those that will result in “no gain no loss” situations.

Transactions Exempted From RPGT

- Private residence: A Malaysian citizen / permanent resident is granted a once-in-a-lifetime RPGT exemption on the gain from disposal of his/her private residence if he/she elects in writing.

- Exemption under Schedule 4: An amount of RM10,000 or 10% of the chargeable gain, whichever is greater, accruing to an individual.

- Special concession to Malaysian citizens: Disposal of residential properties by Malaysian citizens within the period from 1 June 2020 to 31 December 2021 (limited to 3 units per individual).

- Asset-backed securitization transaction: Disposal is in connection with the repurchase of the chargeable assets, to or in favor of the person from whom those assets were acquired/ to or in favor of an SPV (Special Purpose Vehicle).

- REITs and property trust funds: Disposal of assets to REITs and property trust funds which are approved by the Securities Commission. Private residence: A Malaysian citizen / permanent resident is granted a once-in-a-lifetime RPGT exemption on the gain from disposal of his/her private residence if he/she elects in writing.

“No Gain No Loss” Transactions

- Devolution of a deceased person’s assets to his trustee or legatee.

- Transfer between spouses, provided that the disposer is a citizen.

- Gifts made to the Government, State Government, local authority, or an approved charity.

- Disposal due to compulsory acquisition under any law.

- Transfer by way of security in or over an asset.

- Transfer between an individual and a nominee who has no vested interest in the assets.

- Transfer of assets owned by an individual and /or his wife, or a connected person, to a company controlled by the individual, and or his wife, or the connected person, for a consideration consisting wholly or substantially (more than 75%) of shares in that company.

- Disposal of chargeable assets pursuant to an approved financing scheme which is in accordance with Syariah principles, where such disposal will not be required for conventional financing schemes.

- Transfer by way of gift between husband and wife, parent and child, or grandparent and grandchild, provided the donor is a citizen.

- Transfer of real property with prior approval of the Director General of Inland Revenue (DGIR) by a company to companies in the same group to bring about greater efficiency in operation for a consideration consisting of not less than 75% in shares.

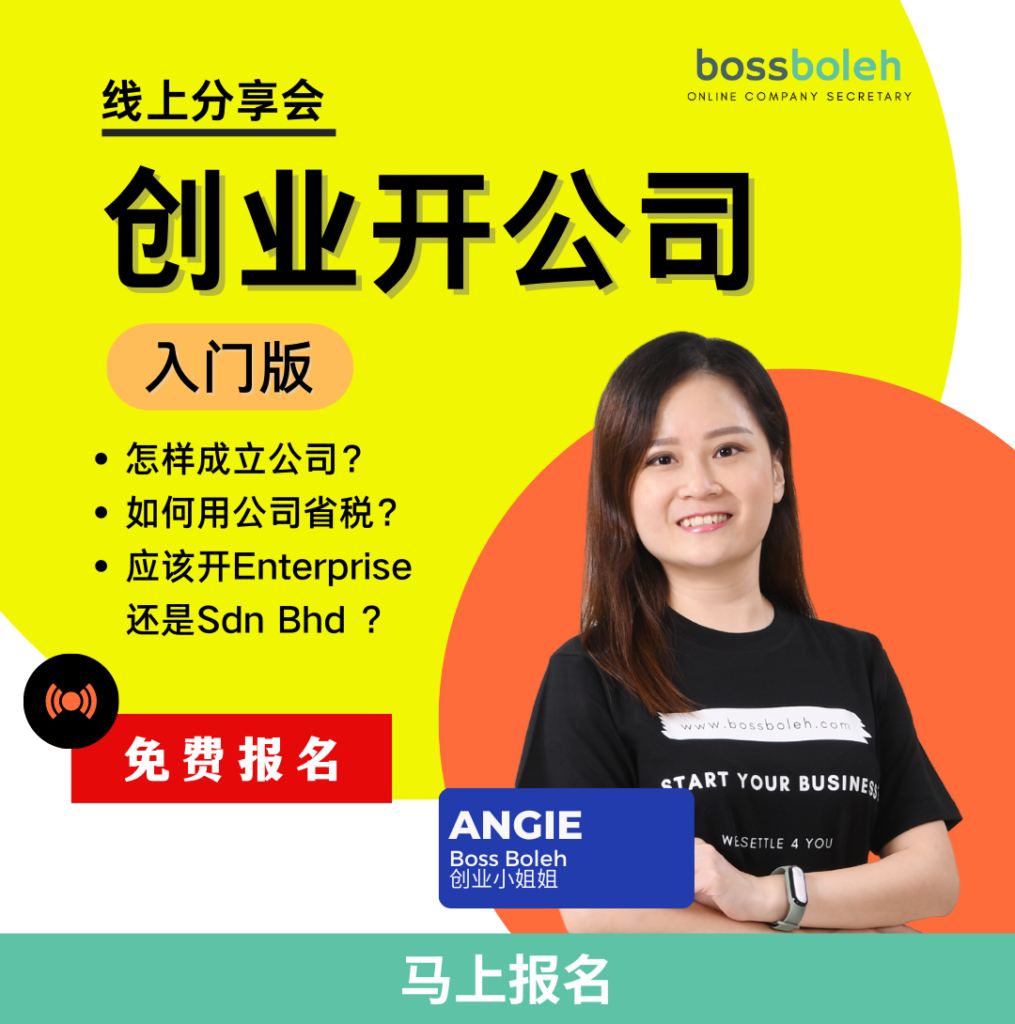

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

For more information, get in touch with us on WhatsApp at 018-7678055!