Starting Year of Assessment 2025, the Inland Revenue Board of Malaysia (LHDN) introduced two new major compliance requirements for companies.

Yes, more forms and more uploads… But don’t worry, we’ll break it down for you!

Because at Boss Boleh, we care, we simplify, and we got your back.

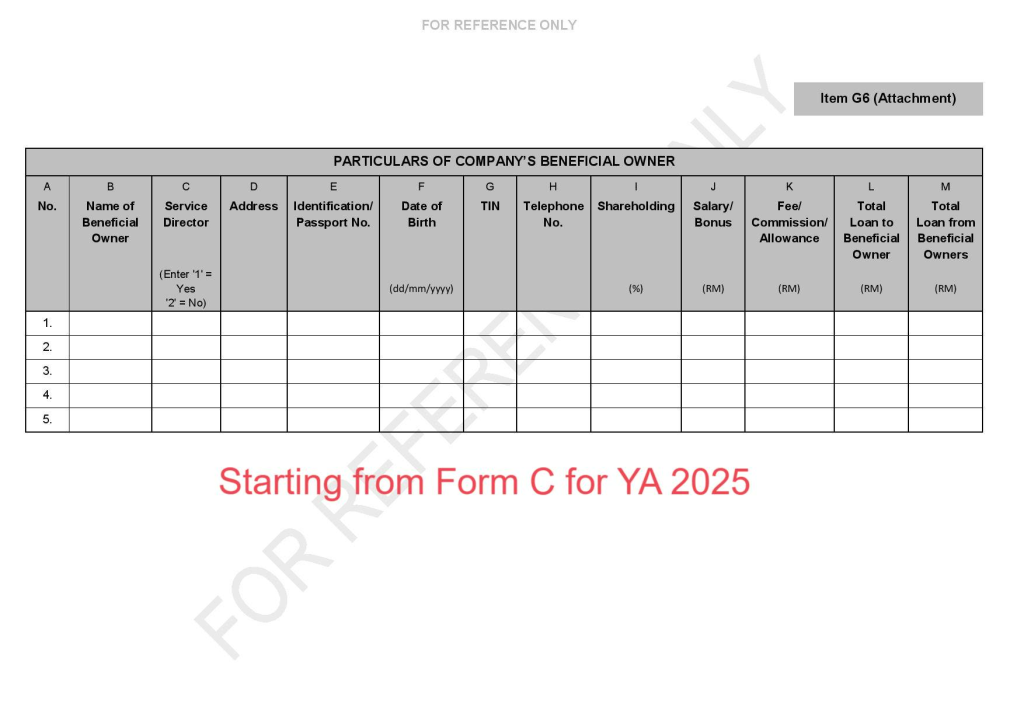

Declare Your Beneficial Owners (BO) in Form C

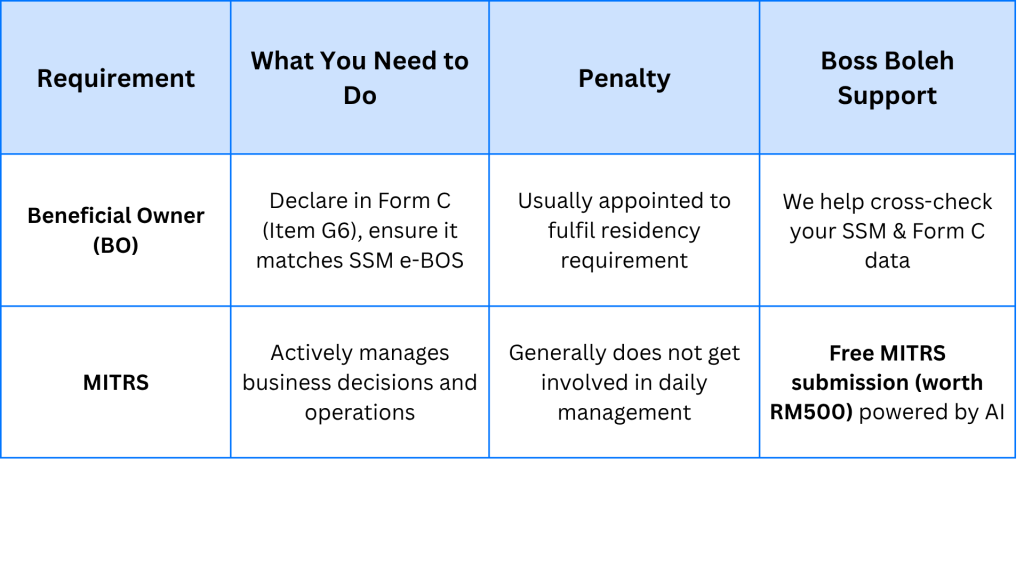

Starting from YA 2025, companies are required to declare Beneficial Owner (BO) information in Item G6 of Form C.

What Is a Beneficial Owner

A Beneficial Owner (BO) is the real person who ultimately owns or controls a company — not a proxy, not a nominee.

Under Section 56 of the Companies Act 2016, every company must identify, maintain, and update their BO details, and lodge them with SSM via the e-BOS system (since April 2024).

Now, LHDN wants that same BO info when you file your Form C — to ensure your tax declaration aligns with your SSM records.

What You Must Declare in Form C (Item G6)

- Name of Beneficial Owner;

- Identification / Passport No. (no prefix needed);

- Residential Address;

- Date of becoming BO; and

- Criteria for identifying as BO.

If your company has fewer than 5 BOs, list all of them.

If there are more than 5, list the 5 most dominant owners.

Make sure the details match your latest SSM e-BOS submission — LHDN and SSM are now cross-checking data.

LHDN (Page 32): https://www.hasil.gov.my/media/forms/upload/form_02611f0e-14a9-4878-ba3c-715de631055b/4701785c-100f-483e-ac26-fac5321238a7/guidebook_c2025_2.pdf

SSM: https://www.ssm.com.my/Pages/FAQ/FAQ-Beneficial-Ownership.aspx

Why LHDN Wants BO Info

This move is to increase transparency and fight money laundering, tax evasion, and hidden ownership structures.

LHDN, SSM, and enforcement agencies will now share data to identify who really controls Malaysian companies.

In short,

“政府要知道谁才是真正的老板。”

(The government wants to know who truly owns the business.)

MITRS: New Online Submission After Form C

The second new rule under Section 82B of the Income Tax Act 1967 requires companies to upload their supporting documents electronically through MITRS (MyTax Integrated Tax Reporting System) — within 30 days after filing Form C.

What You Need to Upload via MITRS

- Audited Financial Statements / Directors’ Report

- Tax Computation

- Capital Allowance & Charges Schedule (if applicable)

- Incentive Computation (if applicable)

Files must be in PDF format (Malay or English), not exceeding 20MB in total per taxpayer per year of assessment.

Penalties

If you fail to submit via MITRS, or upload incomplete files:

💣 Fine: RM2,000 – RM20,000 or 6 months imprisonment (Section 120(1)(d), ITA 1967)”

Even missing one page from your financial statement can be treated as “incomplete.”

LHDN: https://www.hasil.gov.my/media/ttzdgqxl/faq-mitrs_en.pdf

Why the Government Introduced MITRS

LHDN’s goal is simple — digital transparency and real-time data matching.

Through MITRS, LHDN can now:

- Cross-check your audited report with Form C instantly;

- Identify inconsistencies faster; and

- Link data with SSM and banks for automated enforcement.

This is part of Malaysia’s move toward AI-assisted tax administration — where data speaks louder than paper.

So yes, MITRS = more work for companies and tax agents but also more accountability.

Extra Workload = Extra Cost (For Most Firms)

Since MITRS adds another reporting layer, most tax agents will now charge around RM 500 extra just to prepare and upload documents through MITRS.

But not us.

Boss Boleh Does It for FREE (Worth RM500)

At Boss Boleh, we don’t believe compliance should feel like punishment.

That’s why we’ve automated the MITRS submission using our secret AI tool — which formats, verifies, and uploads your tax computations and reports automatically.

So while other firms charge RM500 for MITRS, we provide it FREE for our clients.

Why? Because AI does the heavy lifting — faster, cleaner, and without human error.

Quick Summary

💬 Boss’s one-line summary:

“LHDN wants a clearer view — you just need the right team.”

“The government demands transparency — we help you pass with ease.”

At Boss Boleh,

– We care about your business.

– We simplify compliance.

– And we always got your back.

You’re welcome to join our community group to get exclusive and latest trend of business insight!

① Join EN group

② Join CN group

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

For more information, get in touch with us on WhatsApp @018-767 8055 today!