The Taxability of Foreign-Source Income

Is foreign-source income (FSI) taxable in Malaysia?

Malaysia adopts the territorial principle of taxation where income accruing in or derived from Malaysia or received in Malaysia from outside Malaysia shall be chargeable to tax for that year of assessment (YA) in Malaysia pursuant to Section 3 of the Income Tax Act 1967.

Proposed FSI Tax Treatment in Budget 2022

Previously, effective from YA 2004, FSI received by Malaysian resident was exempted under Paragraph 28, Schedule 6 of the Income Tax Act 1967 (ITA). This exemption had been applicable to any person other than a resident company carrying on the business of banking, insurance, or sea or air transport.

After the Budget 2022 announcement made on 29 October 2021, any income derived from foreign sources and received in Malaysia by a Malaysia tax resident will be subject to tax starting from 1 January 2022 in conjunction with the amendment of the ITA provision.

The proposed changes are as follows:

- Income tax would be charged to Malaysian residents on income derived from foreign sources and received in Malaysia.

- Gross income derived from a source outside of Malaysia and received in Malaysia by its tax residents would be charged an income tax rate of 3% from 1 January 2022 to 30 June 2022. After 1 July 2022, such income would be taxed at the prevailing tax rate.

- Tax Exemption under ITA Schedule 6 Paragraph 28 would still be applicable for any person who is not a tax resident in Malaysia.

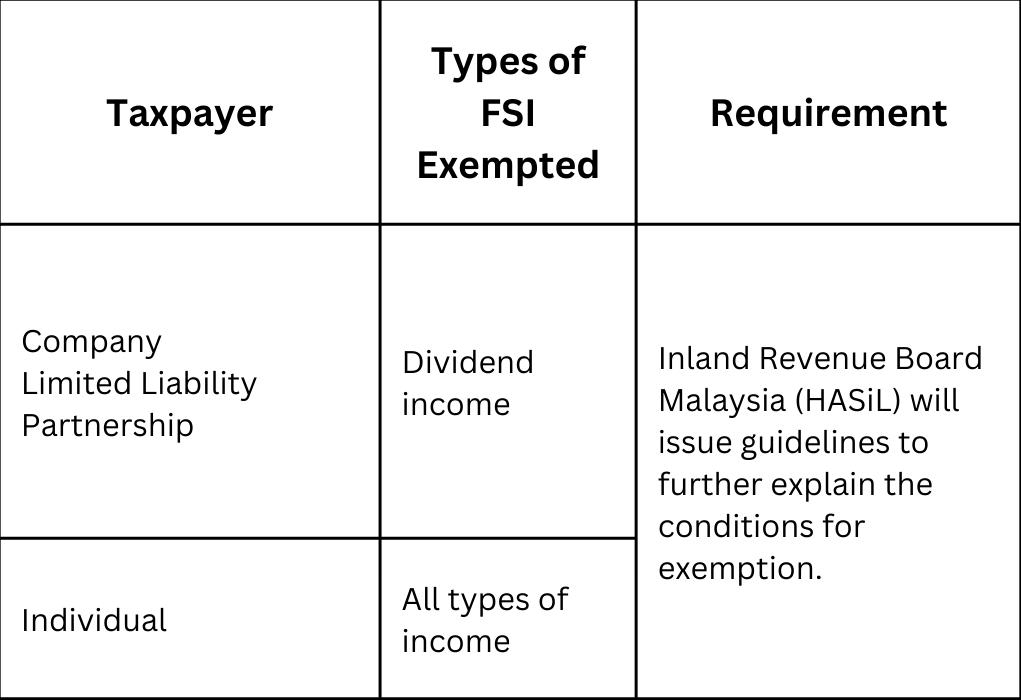

Media Release Issued by Ministry of Finance on Tax Exempted FSI

On 30 December 2021, the Ministry of Finance (MOF) issued a media release stating that the government has agreed to exempt the following FSI to ensure the smooth implementation of this tax initiative. This exemption is effective from 1 January 2022 to 31 December 2026 and applies to all types of FSI for an individual, excluding those who conduct business via partnership in Malaysia.

Termination of “Special Income Remittance Programme”

A “Special Income Remittance Programme” was initially introduced to encourage resident taxpayers to bring back their money from abroad. Under this programme, the FSI remitted and declared by taxpayers will not be subject to tax audit.

However, HASiL has decided to terminate this special programme following the tax exemption announcement made by the MOF on 30 December 2021. This was announced in a media release issued by HASiL on 11 March 2022.

Despite the termination of this special programme, taxable FSI (meaning FSI not entitled to exemption) remitted between 1 January 2022 to 30 June 2022 will still be taxed at a concession rate of 3% and it is required to be reported in the respective tax return. Nevertheless, it is unclear at this juncture whether HASiL will conduct a tax audit on the FSI above. As such, taxpayers are advised to keep and retain all relevant documents for future audit purposes.

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

Are you ready to form your Sdn Bhd with Malaysia’s #1 award-winning Online Company Secretary? Contact us now via WhatsApp @ 018-7678055!