Overview of Transfer Pricing

Transfer pricing generally refers to the intercompany pricing arrangements for the transfer of goods, services, and intangibles between related or associated parties. In an ideal scenario, the transfer price should be the same as the prevailing market price. However, business transactions between associated parties may not always reflect the dynamics of market forces.

In view of this, the Malaysian Inland Revenue Board (HASiL, abbreviated as IRB from here onward) has updated the Transfer Pricing Guidelines 2012 (with effect from 15 July 2017) to take into account new legislations proposed in the 2020 Budget announcement.

The Arm’s Length Principle

Malaysia follows what we call the arm’s length principle to determine transfer prices for transactions between related parties. Prices are only deemed acceptable when they are at arm’s length, which involves comparing controlled and uncontrolled transactions based on factors such as prices, margins, and division of profits. The arm’s length principle is internationally accepted as the preferred basis for determining the transfer price of a transaction between associated persons.

Controlled Transactions and Associate Persons

Pursuant to Section 139 of the Income Tax Act 1967:

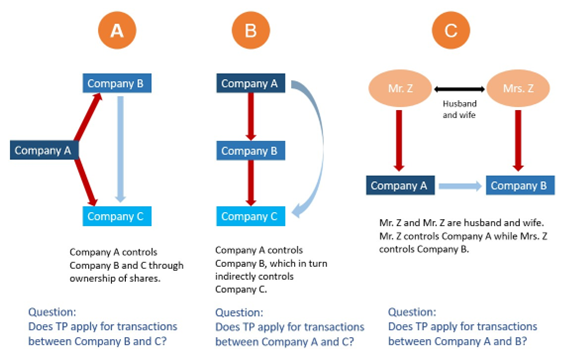

“Control” refers to both direct and indirect control.

“Associate” refers to:

(a) Persons in any of the following relationships to that person, such as husband or wife, parent or remoter forebear, child or remoter issue, brother, sister and partner;

(b) Trustee or trustees of a settlement in relation to which that person is, or any such relative of his as mentioned in paragraph (a);

(c) Where the person is interested in any shares or obligations of a company.

The guidelines are applicable on controlled transactions for the acquisition or supply of property or services between associated persons, where at least one person is assessable or chargeable to tax in Malaysia.

Consider Scenarios A, B, and C:

Full TP or Limited TP?

Full TP documents are only applicable if the company has:

- Annual gross income of more than RM25 million

- Related party transactions of more than RM15 million per annum

- Provision of financial assistance of more than RM50 million for non-financial institutions

In the event that taxpayers fall below the above threshold, they may opt to prepare limited TP documents instead.

Would you like to know whether Transfer Pricing applies to the above scenarios? Do you know what are the documents required for Full TP or Limited TP? Are you aware of the possible penalties that could arise should Transfer Pricing be neglected?

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

For more information, get in touch with us on WhatsApp at 018-7678055!