Personal Tax Clearance Letter

On top of reporting obligations under the Income Tax Act 1967, employers are also responsible for informing the Malaysian Inland Revenue Board (IRB) of an employee’s cessation of employment, retirement, death, or departure from Malaysia for a period exceeding 3 months so that the tax clearance letter (TCL) can be issued. The TCL notifies the employer of the employee’s tax liability to enable the former to make the final payment of salary, compensation, or gratuity to the employee.

Now, let’s consider a few different scenarios.

Scenario 1

Your employee is assigned to Vietnam to set up a factory. What do you need to do?

Scenario 2

Let’s say your employee wishes to resign from your company and go to work in another company. What needs to be done?

Scenario 3

An employee of yours, unfortunately, passed away unexpectedly.

What to do?

Scenario 1: Pursuant to section (s.) 83(4) of the Income Tax Act (ITA) 1967, you will have to submit Form 21 to notify the IRB as to the employee’s departure. Other than that, you have to do it at least 30 days before the expected date of departure.

Scenario 2 and Scenario 3: For both these scenarios, s.83(3) ITA 1967 applies. For private sector companies, Form 22A has to be submitted; for public sector companies, Form 22B has to be submitted. In the event of cessation of employment, the form should be submitted at least 30 days before the date of employment termination. If it is concerning the death of an employee, the employer should submit the notification not more than 30 days after being informed of the death.

Forms 21, 22A, and 22B are prescribed under s.152 of the ITA 1967.

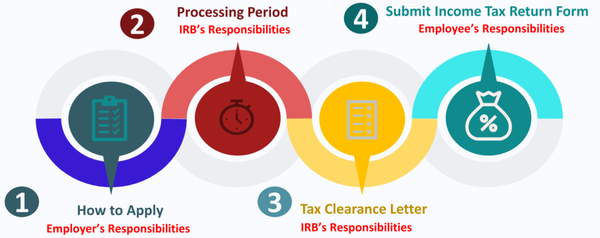

The chart flow below outlines the TCL application process briefly.

Consequence of Non-compliance

The employer who fails to give the notice about the employee who is about to cease employment/ retire/ leave the country shall be liable to:

- a fine of not less than RM2,000 and not more than RM20,000;

- imprisonment for a term not exceeding 6 months;

- or both of the above;

- and be liable for the employee’s outstanding tax obligations.

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

For more information, get in touch with us on WhatsApp at 018-7678055!