Interest Restriction

As defined in Public Ruling No. 2/2011, “interest” is the return or compensation for the use or retention by a person of a sum of money belonging to or owed to another.

How does interest restriction work?

If you have taken a loan, you would have interest expenses incurred on the loan obtained.

Pursuant to section (s.) 33(1) of the Income Tax Act (ITA) 1967, when interest expenses are wholly and exclusively incurred in the production of gross business income, it would be tax deductible. This would be the case when the money is borrowed for business purposes, meaning the loan is employed for the production of gross business income and is laid out on assets for the production of gross business income.

On the contrary, if interest expenses aren’t incurred in the production of gross business income, then it is subject to interest restriction under s.33(2) of the ITA 1967. When we talk about borrowed money being used for non-business purposes, it includes investment in landed properties, shares, securities, and Islamic securities, placement in fixed deposits; and loans (including interest-free loans) given to some other persons. When interest restriction applies, the interest expenses incurred will not be tax deductible.

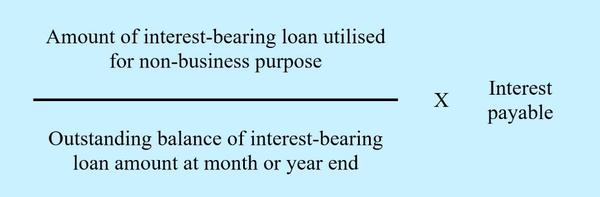

The portion of interest expense to be restricted against the gross business income is computed by using the following formula:

If the total cost of investments and loans which are financed directly or indirectly from the borrowed money does not exceed RM500,000, the s.33(2) interest restriction will be computed based on the end-of-year balance.

However, if the total cost of investments and loans which are financed directly or indirectly from the borrowed money exceeds RM500,000, or there are no investments and loans at the end of the financial year because the investments and loans that are financed directly or indirectly by the borrowed money have been sold, transferred, or repaid during the year, the s.33(2) interest restriction will be applied strictly based on monthly balances and the relevant information should be kept by the taxpayer for tax audit purposes.

Non-Application of Interest Restriction

The s.33(2) interest restriction is not applicable if the interest on borrowed money charged to the business accounts does not exceed RM10,000 for companies and RM6,000 for individuals and others.

If the interest on borrowed money charged to the business accounts exceeds RM10,000 for companies and RM6,000 for individuals and others, then the s.33(2) interest restriction should be applied. However, the interest disallowed for business purposes as a result of applying s.33(2) can be offset against income from investments or loans, whichever is applicable.

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

For more information, get in touch with us on WhatsApp at 018-7678055!