Income Received From Letting of Real Property

Public Ruling No. 12/2018 (PR 12/2018) was issued to clarify the tax treatment on rental income received from the letting of real property. The key difference in tax treatment depends on whether the letting of real property can be deemed as a business source or not.

When the letting of real property is considered a business income, it is subject to section (s.) 4(a) of the Income Tax Act (ITA) 1967, and the following tax treatments will apply:

(i) It can be set off against the aggregate income in the relevant Year of Assessment (YA);

(ii) Capital allowance is available; and

(iii) Deductible expenses include direct and indirect expenses wholly and exclusively incurred in the production of rental income (s.33(1) of ITA 1967).

On the contrary, if the letting of real property is not considered a business income, it is subject to s.4(d) of ITA 1967. Its tax treatment will be significantly different, as shown below:

(i) If there is a current year loss, it will be disregarded;

(ii) No capital allowance is available; and

(iii) Only direct expenses are deductible.

That’s quite a difference, isn’t it? Therefore, it is crucial that we distinguish whether our rental income is a business source or a non-business source income.

How to Determine Whether Rental Income Is a Business Source Income

If the maintenance or support services in relation to the real property are comprehensively and actively provided, then the letting of real property is considered a business source income.

According to PR 12/2018, maintenance or support services comprehensively provided means services that include:

- doing generally all things necessary (eg. cleaning services or repairs) for the maintenance and management of the real property such as the structural elements of the building: stairways, fire escapes, entrances and exits, lobbies, corridors, lifts/escalators, compounds, drains, water tanks, sewers, pipes, wires, cables or other fixtures and fittings; and

- doing generally all things necessary for the maintenance and management of the exterior parts of the real property such as playing fields, recreational areas, driveways, car parks, open spaces, landscape areas, walls and fences, exterior lighting, or other external fixtures and fittings.

In other words, if a person only provides security services or other facilities, that person is not considered to be providing maintenance services or support services comprehensively.

On the other hand, services actively provided mean the person who owns or lets out the real property:

- provides the services himself; or

- hires another person or another firm to provide maintenance services or support services.

Commencement Date on Rental Income

It is essential to determine the commencement date of the letting of real property as only expenses incurred in the production of rental income after the date of commencement are entitled to a tax deduction.

For rental income under s.4(a) of ITA 1967 which is considered business income, the date of commencement is the date when real property is ready to be let out and occupied by tenants. Meanwhile, for rental income under s.4(d) of ITA 1967 which is deemed non-business income, the date of commencement is the date when real property is rented out for the first time.

Do you know which direct expenses can be deducted from rental income? Are you aware that some expenses that fall into the category of initial expenses are not tax-deductible?

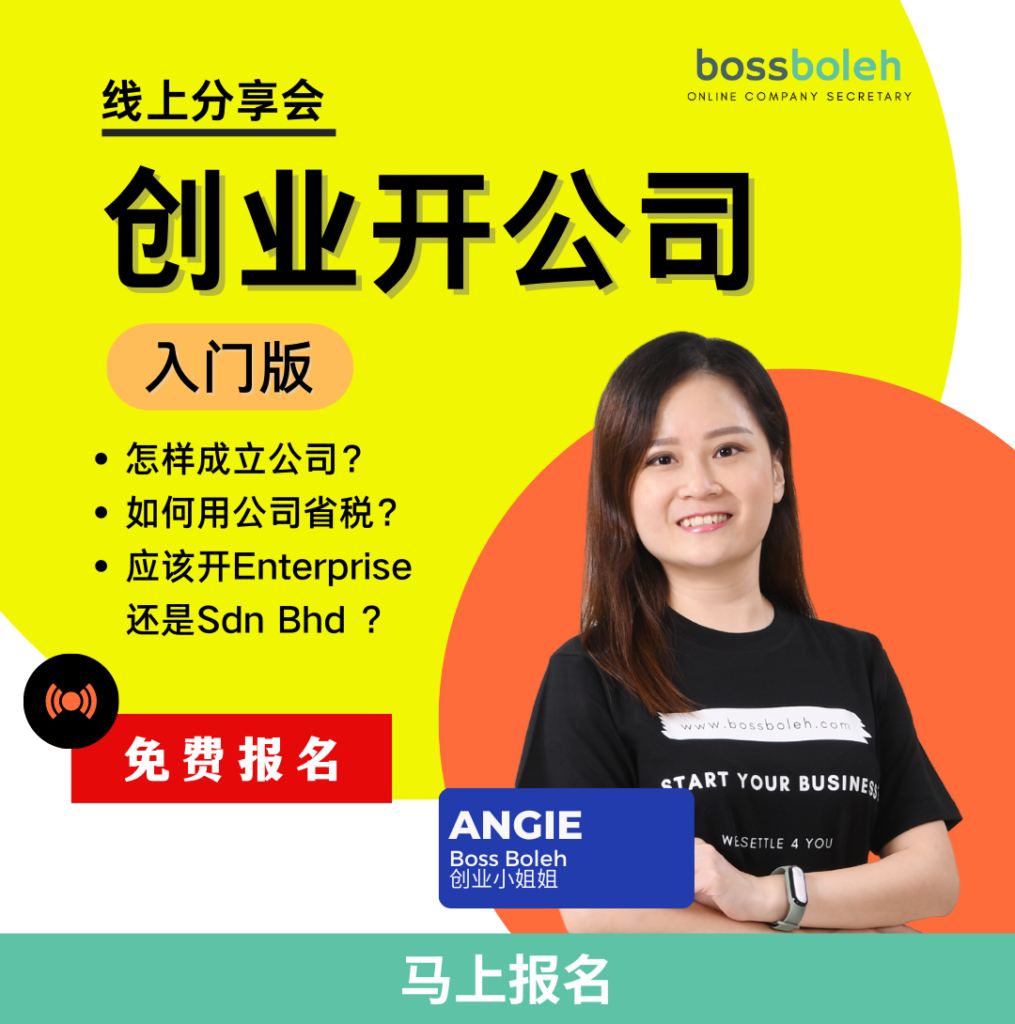

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

For more information, get in touch with us on WhatsApp at @018-7678055!