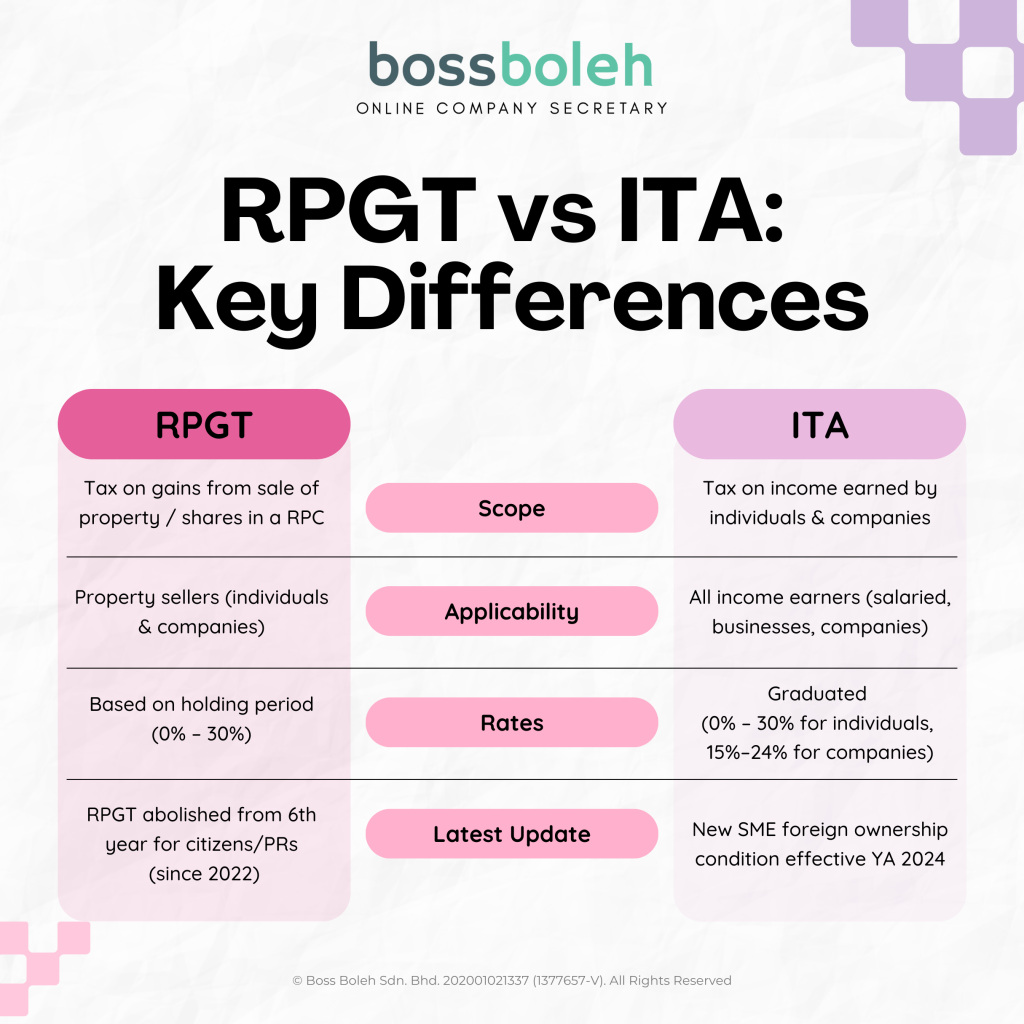

Taxation can be confusing for business owners and property investors in Malaysia. Two areas that are often mixed up are Real Property Gains Tax (RPGT) and Income Tax (ITA). While both are taxes collected by the Inland Revenue Board of Malaysia (LHDN), they apply to different situations.

This article explains the differences between RPGT and ITA and highlights the latest updates as at Year of Assessment (YA) 2025.

What is RPGT (Real Property Gain Tax)?

RPGT (Real Property Gains Tax) is a tax on profits made from selling property or shares in a real property company (RPC). The tax rate depends on how long you have held the property before disposal.

RPGT Rates (YA 2025)

‣ Disposal within 3 years → 30%

‣ Disposal in 4th year → 20%

‣ Disposal in 5th year → 15%

‣ Disposal in 6th year and onwards:

• 0% for Malaysian citizens and permanent residents.

• 10% for companies and non-citizens.

📌 Latest update: Since 1 January 2022, RPGT is abolished for individuals (citizens/PRs) from the 6th year onwards but companies and non-residents still pay 10%. This remains unchanged in YA 2025.

What is ITA (Income Tax Act)?

Income Tax (ITA) applies to income earned by both individuals and companies in Malaysia.

For Individuals (Residents)

• Malaysia uses a graduated system: chargeable income is taxed progressively from 0% up to 30% (depending on income bracket).

For Companies (Residents) YA 2025

• The first RM150,000 of chargeable income → 15%

• The next RM450,000 (i.e. up to RM600,000 total) → 17%

• On chargeable income above RM600,000 → 24%

SME Preferential Corporate Tax Rates (YA 2025)

Small and Medium Enterprises (SMEs) benefit from lower corporate tax rates.

To qualify, a company must meet all of the following conditions:

‣ Paid-up ordinary share capital of RM2.5 million or less at the beginning of the basis period.

‣ Gross business income not exceeding RM50 million in that basis period.

‣ Foreign ownership (direct or indirect) not exceeding 20% of paid-up capital.

⚠️ This foreign ownership condition is new from YA 2024 onwards. Companies exceeding the 20% foreign shareholding cap no longer qualify for SME preferential tax rates.

Both RPGT and ITA are important pillars of Malaysia’s tax system but they apply in very different contexts.

‣ RPGT is about property gains.

‣ ITA covers income from employment, business, and investments.

‣ SMEs can still enjoy preferential tax rates, but must now comply with stricter rules from YA 2024 including the 20% foreign ownership cap.

By understanding these differences and staying updated with the latest tax rules, business owners and property investors can plan better and stay compliant with Malaysian tax law.

📑 Sources:

➊ Inland Revenue Board of Malaysia (LHDN) – Real Property Gains Tax (RPGT) Rates – Official Portal • Public Ruling on SME Tax Treatment (2025) (issued 18 July 2025) – confirms RM50m gross income threshold and foreign ownership ≤ 20% condition.

➋ PwC Malaysia – Corporate Income Tax Guide (Malaysia) – outlines corporate tax rates for SMEs and companies. • Real Property Gains Tax (RPGT) Guide – explains RPGT rates and holding periods.

➌ PwC Worldwide Tax Summaries – Malaysia – Taxes on Corporate Income – Malaysia – confirms YA 2024/25 SME rate conditions (RM50m income cap + 20% foreign ownership).

➍ Low & Partners (Legal Update) – Updates on Real Property Gain Tax (RPGT) 2022 – explains abolition of RPGT from 6th year onwards for citizens/PRs.

Information updated as at Year of Assessment (YA) 2025 based on LHDN guidelines and PwC Malaysia tax summaries.

You’re welcome to join our community group to get exclusive and latest trend of business insight👇

① Join EN group

② Join CN group

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

For more information, get in touch with us on WhatsApp @018-767 8055 today!