All businesses or companies which contain employees within the business shall have to register an employer tax file. The application of registering an income tax reference number, also known as E-number can be done online via e-Daftar on LHDN official website.

For Sole Proprietor and Partnership are to provide the following documents with the application form in order to register an E-number if done physically at the nearest IRBM counter:

1. Copy of Identification Card/ Passport of Candidate/ Partners

2. Copy of up-to-date audited account

3. Copy of Form D – The Certificate of Registration from CCM

4. Copy of an appointment letter as a tax agent for if the registration is done by a tax agent and

5. Copy of Form A – Business Information from CCM or;

6. Copy of an acknowledgement letter from Malaysia Institute of Accountants (MIA) or;

7. Copy of a letter from the Bar Council or;

8. Copy of Form 12 under the Medical Act 1971 or;

9. Copy of Form Q or Form K from The Board of Valuers’ Appraisers and Estate Agents Malaysia.

Sdn Bhd and Berhad Companies are to provide the following documents that are certified by the company secretary with the application form in order to register an E-number if done physically at the nearest IRBM counter:

1. Copy of Memorandum and Articles of Association

2. Two copies of Form 9 – Certificate of Registration from CCM

3. Two copies of Form 13 – Change of company name (if applicable)

4. Two copies of Form 49 – Name and the address of the directors

5. Two copies of Form 24 – List of the shareholders of the company

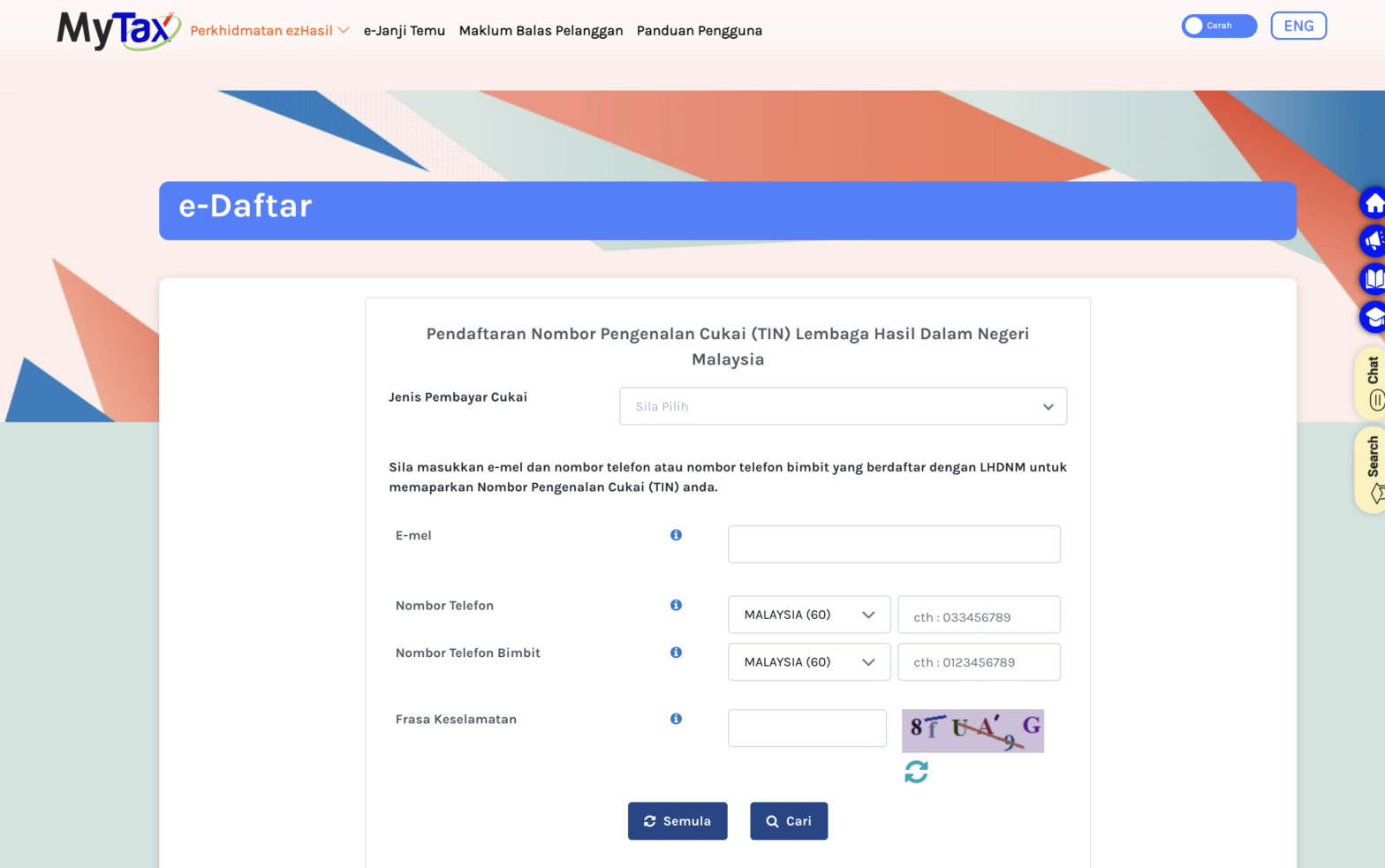

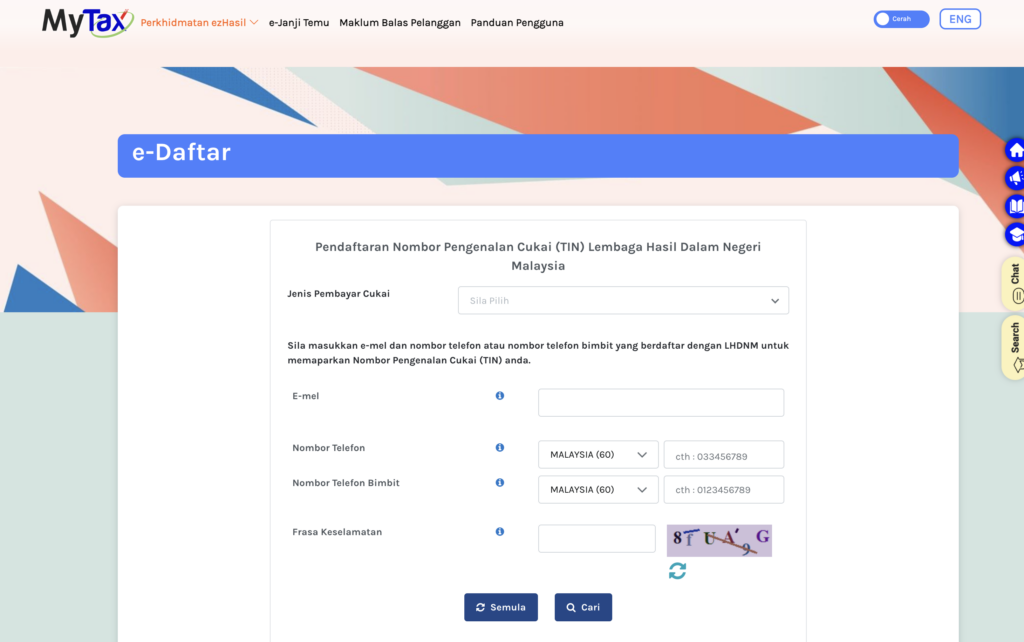

Below is the guide to step-by-step on how to register LHDN Employer Tax File Number (No. Majikan) online via e-Daftar on the LHDN website. Click on this link here for the application.

Step 1 – After clicking on the above link, you will be directed to this page.

Step 2 – Fill in the details such as name of the employee, employer highest designation, tax reference number, and so on in the Maklumat Asas / Basic Information column. (Note that all information with “*” are required to be filled.)

Step 3 – After that, fill in the following columns that are Maklumat Pekerja / Employee Information, Maklumat Majikan, and Akuan (Pengarah/Ejen Cukai/Setiausaha Syarikat) / Declaration (Director/Tax Agent/Company Secretary).

After filling in all the information, click the “Submit” button to send your application to LHDN. You will receive the reference number between 3 to 5 working days.

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

Are you ready to form your Sdn Bhd with Malaysia’s #1 award-winning Online Company Secretary? Contact us now via WhatsApp @018-767 8055